Cost Efficiency and Scalability

Cost efficiency remains a significant driver for the IP Telephony Market. Organizations are increasingly recognizing the financial advantages of adopting IP telephony solutions over traditional telephony systems. The ability to reduce operational costs, particularly in long-distance communication, is appealing to businesses of all sizes. Furthermore, IP telephony systems offer scalability that allows organizations to easily adjust their communication infrastructure as they grow. This flexibility is particularly beneficial for small and medium-sized enterprises, which may have limited budgets. Market data indicates that companies can save up to 40% on communication costs by transitioning to IP telephony. As more businesses seek to optimize their expenditures while enhancing communication capabilities, the IP Telephony Market is likely to experience sustained growth.

Growing Focus on Customer Experience

A growing focus on customer experience is driving the IP Telephony Market as organizations strive to enhance their interactions with clients. Businesses are increasingly aware that effective communication is vital for customer satisfaction and retention. IP telephony solutions provide features such as call routing, interactive voice response (IVR), and real-time analytics, which can significantly improve customer service. As companies aim to differentiate themselves in a competitive market, investing in advanced communication technologies becomes essential. Industry expert's suggest that organizations that prioritize customer experience are likely to see a 20% increase in customer loyalty. This trend underscores the importance of adopting IP telephony solutions that facilitate better communication and engagement, thereby propelling the growth of the IP Telephony Market.

Integration with Unified Communications

The integration of IP telephony with unified communications (UC) systems is emerging as a key driver for the IP Telephony Market. Organizations are increasingly seeking solutions that combine voice, video, messaging, and collaboration tools into a single platform. This integration not only streamlines communication processes but also enhances productivity by providing users with a cohesive experience. As businesses recognize the benefits of UC, the demand for IP telephony solutions that can seamlessly integrate with these systems is likely to rise. Market data indicates that the UC market is expected to grow significantly, which will, in turn, bolster the IP Telephony Market. The ability to offer integrated solutions positions IP telephony providers favorably in a competitive landscape, as organizations prioritize comprehensive communication strategies.

Technological Advancements in Communication

Technological advancements play a crucial role in driving the IP Telephony Market. Innovations such as Voice over Internet Protocol (VoIP), high-definition voice, and video conferencing capabilities are transforming how organizations communicate. The integration of advanced features, such as call analytics and customer relationship management (CRM) tools, enhances the overall user experience. As technology continues to evolve, businesses are increasingly inclined to adopt IP telephony solutions that offer these cutting-edge functionalities. Industry expert's suggests that the adoption of advanced communication technologies is expected to increase by 25% in the coming years. This trend indicates a growing recognition of the value that modern communication tools bring to organizational efficiency and customer engagement, thereby propelling the IP Telephony Market.

Rising Demand for Remote Communication Solutions

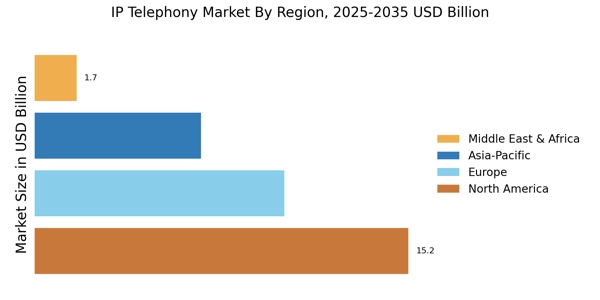

The increasing need for remote communication solutions is a primary driver of the IP Telephony Market. As organizations continue to embrace flexible work arrangements, the demand for reliable and efficient communication tools has surged. According to recent data, the market for IP telephony is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is largely attributed to the necessity for seamless communication among distributed teams. Businesses are increasingly adopting IP telephony solutions to enhance collaboration and maintain productivity, which is likely to further propel the market forward. The IP Telephony Market is thus positioned to benefit from this trend, as companies seek to implement cost-effective and scalable communication systems that can support remote work environments.